| | |

|

|

|

|

| Index (2026-02-25 5:19:20 PM) | Latest

| Change

| YTD

|

| Dow Jones | 49,482.15 | 307.65 | 2.95% |

| NASDAQ Composite | 23,152.08 | 288.40 | -0.39% |

| Russell 2000 | 2,663.33 | 11.00 | 7.31% |

| S&P 500 | 6,946.13 | 56.06 | 1.47% |

|

Real-Time Daily Market News

Real-Time Daily Market News |

|

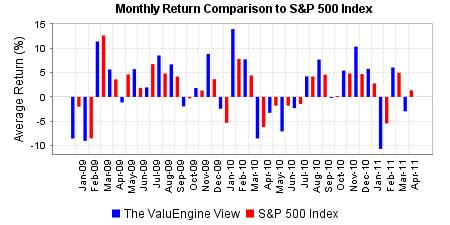

| The ValuEngine View portfolio is constructed by integrating

this model along with some basic rules for market capitalization and industry

diversification. The portfolio has 15 stocks and is balanced once each month.

more details....

|

|

|

| VE Benchmark Portfolios are constructed to represent different trading strategies

that can be used by investors with varying styles and risk-tolerance preferences.

more details....

|

|

|

|

|

|---|

| My Services |

|---|

ValuEngine Stock Analysis Membership

ValuEngine Stock Analysis Membership |

|

|

|

|---|

Monthly ValuEngine View Newsletter

Monthly ValuEngine View Newsletter |

|

|

|

|---|

|

|---|

| ValuEngine Products and Services |

|---|

|

ValuEngine Stock Analysis Membership

|

|---|

| Sign Up Now to receive a free 14-day trial

and complimentary Weekly Market Newsletter.

|

|---|

|

Premium membership on ValuEngine.com gives you the complete ValuEngine toolbox. You'll have everything you need to make the VE Stock Evaluation Models work for you and substantially increase your chances of success in the Market.

Click HERE for more information.

|

|

|

|---|

|

Monthly ValuEngine View Newsletter

|

|---|

|

This is the product of a sophisticated stock valuation model that was first developed by Yale Professor of Finance Zhiwu Chen and his coauthors.

|

|

|

|---|

|

Stock & Industry Research Reports

|

|---|

ValuEngine and other providers deliver real-time independent and industry research

valuations on more than 10,000 U.S. companies in 200 U.S. industries,

totaling some 20,000 reports.

ValuEngine Reports are distributed through reputable Financial media such as Reuters,

Yahoo! Finance, CBS MarketWatch, Hoover's, BNY Jaywalk, Thomson Financial,

Investrend.com etc. and widely referenced by Finance Industry professionals.

|

|

|

|

|

|---|

|

ValuEngine Institutional Software

|

|---|

|

VE Institutional's objective is to provide customers with immediate, efficient quantitative tools for analyzing stocks and equity portfolios to create maximum return for minimum risk.

|

|

|

|---|

|

Customized Data Feed

|

|---|

ValuEngine does extensive work with hedge funds and other institutional level investors. Each project varies and generally involves a customized daily or inter-day feed of ValuEngine's Valuation and/or Forecast data.

- Click HERE for more information.

- Subscribers click HERE to login.

|

|

|---|

|

|---|

|

Contact ValuEngine: (321) 325-0519, support@valuengine.com

Data is provided for informational purposes only.

Quotes, analyst research, earnings information, and financial data provided by Zacks.

Copyright 1998-2020 ValuEngine Inc. All Rights Reserved.