October 26, 2018

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Index

|

Week Open

|

Friday PM

|

Change

|

% Change

|

YTD

|

DJIA |

25492.14 |

24688.31 |

-803.83 |

-3.15% |

-0.13% |

NASDAQ |

7486.74 |

7167.21 |

-319.53 |

-4.27% |

3.82% |

RUSSELL 2000 |

1542.42 |

1486.69 |

-55.73 |

-3.61% |

-3.18% |

S&P 500 |

2773.94 |

2658.68 |

-115.26 |

-4.16% |

-0.56% |

ValuEngine Market Overview

Summary of VE Stock Universe |

|

Stocks Undervalued |

63.02% |

Stocks Overvalued |

36.98% |

Stocks Undervalued by 20% |

30.17% |

Stocks Overvalued by 20% |

13.73% |

ValuEngine Sector Overview

Sector

|

Change

|

MTD

|

YTD

|

Valuation

|

Last 12-MReturn

|

P/E Ratio

|

| Consumer Staples | 0.51% |

-3.80% |

-4.43% |

5.74% overvalued |

3.60% |

23.48 |

| Utilities | 1.32% |

-2.49% |

-1.14% |

5.26% overvalued |

-5.93% |

20.47 |

| Medical | 0.72% |

-10.14% |

8.88% |

3.01% overvalued |

21.01% |

27.90 |

| Aerospace | 0.09% |

-8.98% |

-0.82% |

2.38% overvalued |

-0.54% |

25.02 |

| Retail-Wholesale | 1.47% |

-7.98% |

-3.99% |

1.13% overvalued |

15.45% |

21.78 |

| Computer and Technology | 1.14% |

-9.30% |

-1.04% |

0.94% overvalued |

7.24% |

28.65 |

| Business Services | 0.50% |

-8.67% |

3.24% |

1.20% undervalued |

3.76% |

22.03 |

| Consumer Discretionary | 1.02% |

-8.03% |

-5.38% |

3.87% undervalued |

6.19% |

23.51 |

| Transportation | 0.97% |

-7.57% |

-7.48% |

4.50% undervalued |

0.00% |

18.86 |

| Multi-Sector Conglomerates | 0.58% |

-10.09% |

-11.62% |

5.04% undervalued |

-8.29% |

17.22 |

| Finance | 1.05% |

-5.95% |

-5.53% |

6.33% undervalued |

-2.94% |

15.85 |

| Industrial Products | 0.68% |

-11.53% |

-9.42% |

11.24% undervalued |

-4.12% |

21.21 |

| Auto-Tires-Trucks | 1.81% |

-13.03% |

-16.73% |

15.08% undervalued |

-20.92% |

10.92 |

| Basic Materials | -0.06% |

-7.85% |

-6.96% |

17.69% undervalued |

-11.31% |

18.53 |

| Construction | 0.73% |

-11.46% |

-12.48% |

19.43% undervalued |

-11.33% |

17.21 |

| Oils-Energy | 0.54% |

-8.49% |

-0.63% |

22.72% undervalued |

4.11% |

20.03 |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

Sector Talk--Finance

Below, we present the latest data on Finance

stocks from our Professional Stock Analysis Service. Top-

five lists are provided for each category. We applied some basic

liquidity criteria--share price greater than $3 and average daily

volume in excess of 100k shares.

Top-Five Finance Stocks--Short-Term Forecast Returns

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

MFIN |

MEDALLION FINL |

6.5 |

53.55% |

191.48% |

GFN |

GENERAL FINANCE |

13.6 |

65.31% |

156.60% |

DS |

DRIVE SHACK INC |

5.33 |

45.57% |

46.43% |

CNNE |

CANNAE HOLDINGS |

18.66 |

59.04% |

4.83% |

CME |

CME GROUP INC |

180.8 |

24.50% |

34.31% |

Top-Five Finance Stocks--Momentum

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

MFIN |

MEDALLION FINL |

6.5 |

53.55% |

191.48% |

GFN |

GENERAL FINANCE |

13.6 |

65.31% |

156.60% |

HIIQ |

HEALTH INS INN |

45.83 |

14.70% |

118.24% |

OFG |

OFG BANCORP |

17.55 |

19.97% |

115.34% |

FBP |

FIRST BNCRP P R |

9.15 |

14.27% |

94.27% |

Top-Five Finance Stocks--Composite Score

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

PGR |

PROGRESSIVE COR |

69.44 |

3.61% |

42.00% |

SIVB |

SVB FINL GP |

273.31 |

-14.64% |

46.31% |

BPOP |

POPULAR INC |

50.06 |

-2.08% |

55.03% |

CACC |

CREDIT ACCEPT |

409.04 |

7.36% |

43.45% |

BSBR |

BANCO SANT-ADS |

11.21 |

30.95% |

21.32% |

Top-Five Finance Stocks--Most Overvalued

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

GLRE |

GREENLIGHT CAP |

11.39 |

130.09% |

-49.93% |

BBDC |

BARINGS BDC INC |

10.04 |

123.94% |

-21.87% |

GFN |

GENERAL FINANCE |

13.6 |

65.31% |

156.60% |

CNNE |

CANNAE HOLDINGS |

18.66 |

59.04% |

4.83% |

MFIN |

MEDALLION FINL |

6.5 |

53.55% |

191.48% |

Free Download for Readers

As a bonus to our Free Weekly Newsletter subscribers,

we are offering a FREE DOWNLOAD of one of our Stock Reports

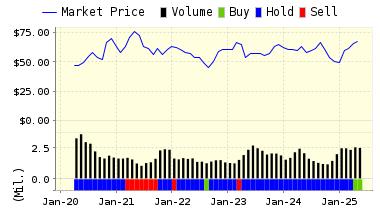

Anheuser Busch Inbev NV (BUD) is a Belgium-based company engaged in the brewers industry. The Company owns a portfolio of over 200 beer brands. The Company's brand portfolio includes global brands, such as Budweiser, Corona and Stella Artois; international brands, including Beck's, Leffe and Hoegaarden, and local champions, such as Bud Light, Skol, Brahma, Antarctica, Quilmes, Victoria, Modelo Especial, Michelob Ultra, Harbin, Sedrin, Klinskoye, Sibirskaya Korona, Chernigivske, Cass and Jupiler. The Company's soft drinks business consists of both own production and agreements with PepsiCo related to bottling and distribution arrangements between its various subsidiaries and PepsiCo. Ambev, which is a subsidiary of the Company, is a PepsiCo bottler. Brands that are distributed under these agreements are Pepsi, 7UP and Gatorade.

VALUENGINE RECOMMENDATION: ValuEngine continues its SELL recommendation on Anheuser Busch Inbev for 2018-10-25. Based on the information we have gathered and our resulting research, we feel that Anheuser Busch Inbev has the probability to UNDERPERFORM average market performance for the next year. The company exhibits UNATTRACTIVE Momentum and Sharpe Ratio.

You can download a free copy of detailed report on Anheuser Busch Inbev NV (BUD) from the link below.

Read our Complete Rating and Forecast Report HERE.

ValuEngine Forecast |

||

Target Price* |

Expected Return |

|

|---|---|---|

1-Month |

81.69 | -0.68% |

3-Month |

81.68 | -0.69% |

6-Month |

79.85 | -2.92% |

1-Year |

75.50 | -8.21% |

2-Year |

76.84 | -6.57% |

3-Year |

74.41 | -9.53% |

Valuation & Rankings |

|||

Valuation |

21.57% undervalued | Valuation Rank(?) | |

1-M Forecast Return |

-0.68% | 1-M Forecast Return Rank | |

12-M Return |

-33.67% | Momentum Rank(?) | |

Sharpe Ratio |

-0.12 | Sharpe Ratio Rank(?) | |

5-Y Avg Annual Return |

-2.49% | 5-Y Avg Annual Rtn Rank | |

Volatility |

20.04% | Volatility Rank(?) | |

Expected EPS Growth |

42.23% | EPS Growth Rank(?) | |

Market Cap (billions) |

132.14 | Size Rank | |

Trailing P/E Ratio |

22.05 | Trailing P/E Rank(?) | |

Forward P/E Ratio |

15.50 | Forward P/E Ratio Rank | |

PEG Ratio |

0.52 | PEG Ratio Rank | |

Price/Sales |

2.34 | Price/Sales Rank(?) | |

Market/Book |

1.75 | Market/Book Rank(?) | |

Beta |

0.91 | Beta Rank | |

Alpha |

-0.44 | Alpha Rank | |

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.com