February 9, 2018

This week, we provide top-five ranked VE data for our Utilities Sector stocks. We take a look at our latest data on Bank of America $BAC and provide a free download link for our stock report on the company. Overvaluation has declined below 60% and therefore we have ended our latest Valuation Watch. VALUATION WATCH: Overvalued stocks now make up 60.08% of our stocks assigned a valuation and 26.61% of those equities are calculated to be overvalued by 20% or more. Eleven sectors are calculated to be overvalued.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Index

|

Week Open

|

Friday PM

|

Change

|

% Change

|

YTD

|

DJIA |

25337.87 |

23841.78 |

-301.76 |

-1.14% |

-3.55% |

NASDAQ |

7165.96 |

6776.69 |

-55.74 |

-0.74% |

-1.84% |

RUSSELL 2000 |

1544.94 |

1467.78 |

-29.45 |

-1.83% |

-4.41% |

S&P 500 |

2741.06 |

2578.76 |

-34.23 |

-1.19% |

-3.55% |

ValuEngine Market Overview

Summary of VE Stock Universe |

|

Stocks Undervalued |

52.2% |

Stocks Overvalued |

47.8% |

Stocks Undervalued by 20% |

21.1% |

Stocks Overvalued by 20% |

16.7% |

ValuEngine Sector Overview

Sector

|

Change

|

MTD

|

YTD

|

Valuation

|

Last 12-MReturn

|

P/E Ratio

|

| Aerospace | -2.34% |

-5.85% |

-1.15% |

19.50% overvalued |

17.49% |

22.28 |

| Computer and Technology | -3.18% |

-6.90% |

-3.24% |

11.17% overvalued |

24.51% |

30.96 |

| Consumer Discretionary | -2.01% |

-4.75% |

-2.10% |

10.69% overvalued |

20.60% |

24.00 |

| Multi-Sector Conglomerates | -1.83% |

-6.14% |

-1.58% |

7.63% overvalued |

12.56% |

24.43 |

| Transportation | -2.41% |

-6.23% |

-3.31% |

5.96% overvalued |

18.39% |

21.91 |

| Construction | -2.13% |

-4.40% |

-1.46% |

4.82% overvalued |

20.96% |

21.53 |

| Business Services | -2.27% |

-5.77% |

-1.53% |

3.40% overvalued |

13.91% |

25.09 |

| Industrial Products | -2.11% |

-5.66% |

-3.44% |

3.34% overvalued |

17.48% |

24.47 |

| Medical | -2.17% |

-5.21% |

0.32% |

2.71% overvalued |

41.21% |

28.65 |

| Consumer Staples | -1.41% |

-4.97% |

-3.90% |

2.27% overvalued |

15.97% |

24.95 |

| Auto-Tires-Trucks | -2.58% |

-5.60% |

-2.29% |

0.58% overvalued |

21.84% |

14.43 |

| Finance | -2.06% |

-5.22% |

-3.32% |

1.16% undervalued |

7.13% |

17.86 |

| Retail-Wholesale | -1.91% |

-5.48% |

-4.43% |

2.53% undervalued |

12.13% |

23.77 |

| Utilities | -1.94% |

-7.50% |

-8.23% |

2.93% undervalued |

3.23% |

21.08 |

| Basic Materials | -1.98% |

-5.69% |

-2.23% |

5.57% undervalued |

-0.69% |

23.10 |

| Oils-Energy | -2.70% |

-7.55% |

-3.28% |

18.61% undervalued |

-6.81% |

28.37 |

Sector Talk--Utilities

Below, we present the latest data on Utilities

stocks from our Professional Stock Analysis Service. Top-

five lists are provided for each category. We applied some basic

liquidity criteria--share price greater than $3 and average daily

volume in excess of 100k shares.

Top-Five Utilities Stocks--Short-Term Forecast Returns

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

EOCC |

ENDESA-CHILE |

27.58 |

N/A |

46.55% |

TEF |

TELEFONICA S.A. |

9.23 |

N/A |

-2.84% |

SBS |

SABESP -ADR |

10.14 |

1.16% |

-2.41% |

EONGY |

E.ON AG-ADR |

9.8 |

N/A |

30.67% |

ENIA |

ENERSIS S A ADR |

11.09 |

N/A |

15.76% |

Top-Five Utilities Stocks--Momentum

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

VG |

VONAGE HOLDINGS |

10.37 |

66.22% |

55.47% |

NRG |

NRG ENERGY INC |

24 |

-28.66% |

46.70% |

EOCC |

ENDESA-CHILE |

27.58 |

N/A |

46.55% |

ENLAY |

ENEL SOCIETA PR |

5.66 |

N/A |

34.44% |

PAM |

PAMPA ENERGIA |

61.14 |

N/A |

33.58% |

Top-Five Utilities Stocks--Composite Score

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

FE |

FIRSTENERGY CP |

30.64 |

-10.02% |

2.00% |

BIP |

BROOKFIELD INFR |

40.4 |

-4.33% |

13.20% |

ETR |

ENTERGY CORP |

72.02 |

-4.78% |

0.87% |

VZ |

VERIZON COMM |

49.04 |

-1.78% |

1.39% |

EXC |

EXELON CORP |

35.98 |

-1.69% |

2.13% |

Top-Five Utilities Stocks--Most Overvalued

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

VG |

VONAGE HOLDINGS |

10.37 |

66.22% |

55.47% |

SHEN |

SHENANDOAH TELE |

30.5 |

49.82% |

15.97% |

WGL |

WGL HLDGS INC |

84.29 |

26.69% |

1.21% |

AWR |

AMER STATES WTR |

50.34 |

21.21% |

14.72% |

AY |

ATLANTICA YIELD |

19.69 |

17.16% |

-7.47% |

Free Download for Readers

As a bonus to our Free Weekly Newsletter subscribers,

we are offering a FREE DOWNLOAD of one of our Stock Reports

Bank of America (BAC) is one of the world's leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 47 million consumer and small business relationships with approximately 4,500 retail financial centers, approximately 16,000 ATMs, and award-winning digital banking with approximately 34 million active users, including approximately 24 million mobile users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business owners through a suite of innovative, easy-to-use online products and services.

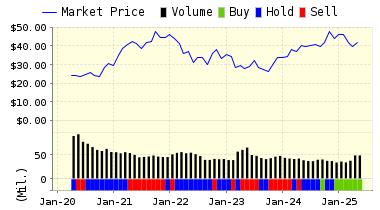

VALUENGINE RECOMMENDATION: ValuEngine continues its BUY recommendation on Bank of America for 2018-02-08. Based on the information we have gathered and our resulting research, we feel that Bank of America has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Sharpe Ratio.

You can download a free copy of detailed report on Bank of America (BAC) from the link below.

Read our Complete Rating and Forecast Report HERE.

ValuEngine Forecast |

||

Target Price* |

Expected Return |

|

|---|---|---|

1-Month |

167.93 | 0.30% |

3-Month |

166.05 | -0.83% |

6-Month |

166.86 | -0.34% |

1-Year |

173.45 | 3.60% |

2-Year |

166.19 | -0.74% |

3-Year |

162.38 | -3.02% |

Valuation & Rankings |

|||

Valuation |

2.97% overvalued | Valuation Rank(?) | |

1-M Forecast Return |

0.30% | 1-M Forecast Return Rank | |

12-M Return |

37.97% | Momentum Rank(?) | |

Sharpe Ratio |

0.67 | Sharpe Ratio Rank(?) | |

5-Y Avg Annual Return |

16.00% | 5-Y Avg Annual Rtn Rank | |

Volatility |

23.84% | Volatility Rank(?) | |

Expected EPS Growth |

15.84% | EPS Growth Rank(?) | |

Market Cap (billions) |

975.24 | Size Rank | |

Trailing P/E Ratio |

17.33 | Trailing P/E Rank(?) | |

Forward P/E Ratio |

14.96 | Forward P/E Ratio Rank | |

PEG Ratio |

1.09 | PEG Ratio Rank | |

Price/Sales |

4.25 | Price/Sales Rank(?) | |

Market/Book |

7.74 | Market/Book Rank(?) | |

Beta |

1.18 | Beta Rank | |

Alpha |

0.17 | Alpha Rank | |

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

If you no longer wish to receive this free newsletter, CLICK HERE to unsubscribe