February 16, 2018

This week, we provide top-five ranked VE data for our Finance Sector stocks. We take a look at our latest data on Cisco Systems $CSCO and provide a free download link for our stock report on the company. VALUATION WATCH: Overvalued stocks now make up 55.58% of our stocks assigned a valuation and 21.79% of those equities are calculated to be overvalued by 20% or more. FIfteen sectors are calculated to be overvalued.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Index

|

Week Open

|

Friday PM

|

Change

|

% Change

|

YTD

|

DJIA |

24337.76 |

25368.97 |

1031.21 |

4.24% |

2.63% |

NASDAQ |

6936.68 |

7290.6 |

353.92 |

5.10% |

5.61% |

RUSSELL 2000 |

1479.11 |

1550.08 |

70.97 |

4.80% |

0.95% |

S&P 500 |

2636.75 |

2747.73 |

110.98 |

4.21% |

2.77% |

ValuEngine Market Overview

Summary of VE Stock Universe |

|

Stocks Undervalued |

44.42% |

Stocks Overvalued |

55.58% |

Stocks Undervalued by 20% |

18.43% |

Stocks Overvalued by 20% |

21.79% |

ValuEngine Sector Overview

Sector

|

Change

|

MTD

|

YTD

|

Valuation

|

Last 12-MReturn

|

P/E Ratio

|

1.41% |

-1.11% |

3.74% |

28.89% overvalued |

22.45% |

24.31 |

|

1.02% |

-2.78% |

1.07% |

18.54% overvalued |

27.86% |

31.72 |

|

0.42% |

-2.02% |

0.78% |

14.75% overvalued |

20.52% |

25.39 |

|

1.04% |

-4.24% |

0.41% |

12.16% overvalued |

13.93% |

20.96 |

|

-0.25% |

-4.68% |

-1.52% |

11.28% overvalued |

16.93% |

21.99 |

|

0.72% |

-1.42% |

3.12% |

8.92% overvalued |

16.27% |

25.39 |

|

0.59% |

-1.83% |

1.01% |

8.49% overvalued |

21.59% |

22.27 |

|

0.75% |

-2.94% |

0.20% |

8.21% overvalued |

21.97% |

14.80 |

|

0.75% |

-2.29% |

3.66% |

7.68% overvalued |

41.42% |

29.10 |

|

0.80% |

-3.00% |

-0.71% |

7.16% overvalued |

17.90% |

23.95 |

|

0.72% |

-2.16% |

-1.27% |

5.78% overvalued |

17.15% |

25.63 |

|

0.66% |

-2.59% |

-1.46% |

2.98% overvalued |

14.19% |

24.60 |

|

0.41% |

-2.49% |

-0.48% |

2.72% overvalued |

8.37% |

18.34 |

|

0.30% |

-2.24% |

1.30% |

0.58% overvalued |

0.81% |

24.24 |

|

1.30% |

-5.16% |

-5.64% |

0.10% overvalued |

4.79% |

22.05 |

|

0.11% |

-5.68% |

-1.34% |

16.67% undervalued |

-7.94% |

29.24 |

Sector Talk--Finance

Below, we present the latest data on Finance

stocks from our Professional Stock Analysis Service. Top-

five lists are provided for each category. We applied some basic

liquidity criteria--share price greater than $3 and average daily

volume in excess of 100k shares.

Top-Five Finance Stocks--Short-Term Forecast Returns

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

PFSI |

PENNYMAC FIN SV |

23.65 |

37.70% |

27.84% |

MTG |

MGIC INVSTMT CP |

14.3 |

31.56% |

28.83% |

WRLD |

WORLD ACCEPTANC |

110.56 |

53.08% |

107.98% |

SC |

SANTANDER CNSMR |

17 |

32.73% |

17.08% |

APO |

APOLLO GLOBAL-A |

34.52 |

14.83% |

49.57% |

Top-Five Finance Stocks--Momentum

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

TREE |

LENDINGTREE INC |

376.1 |

66.79% |

228.76% |

LGIH |

LGI HOMES INC |

64.95 |

-12.49% |

124.35% |

WRLD |

WORLD ACCEPTANC |

110.56 |

53.08% |

107.98% |

TBBK |

BANCORP BNK/THE |

10.7 |

-14.41% |

100.00% |

TRUP |

TRUPANION INC |

29.68 |

52.97% |

74.69% |

Top-Five Finance Stocks--Composite Score

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

CG |

CARLYLE GROUP |

24 |

-20.39% |

46.79% |

RBS |

ROYAL BK SC-ADR |

7.92 |

-10.59% |

28.57% |

UBS |

UBS GROUP AG |

19.19 |

-11.13% |

19.64% |

LGIH |

LGI HOMES INC |

64.95 |

-12.49% |

124.35% |

JHG |

JANUS HENDERSON |

35.52 |

-13.07% |

33.56% |

Top-Five Finance Stocks--Most Overvalued

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

DS |

DRIVE SHACK INC |

5.21 |

185.95% |

21.73% |

ASPS |

ALTISOURCE PORT |

27.15 |

132.50% |

-11.82% |

BFR |

BANCO FRANC-ADR |

24.7 |

71.76% |

29.80% |

TREE |

LENDINGTREE INC |

376.1 |

66.79% |

228.76% |

NMIH |

NMI HOLDINGS-A |

19 |

62.79% |

64.50% |

Free Download for Readers

As a bonus to our Free Weekly Newsletter subscribers,

we are offering a FREE DOWNLOAD of one of our Stock Reports

Cisco Systems, Inc. (CSCO) is the worldwide leader in IT that helps companies seize the opportunities of tomorrow by proving that amazing things can happen when you connect the previously unconnected. At Cisco customers come first and an integral part of their DNA is creating long-lasting customer partnerships and working with them to identify their needs and provide solutions that support their success. The concept of solutions being driven to address specific customer challenges has been with Cisco since its inception. Husband and wife Len Bosack and Sandy Lerner, both working for Stanford University, wanted to email each other from their respective offices located in different buildings but were unable to due to technological shortcomings. A technology had to be invented to deal with disparate local area protocols; and as a result of solving their challenge - the multi-protocol router was born.

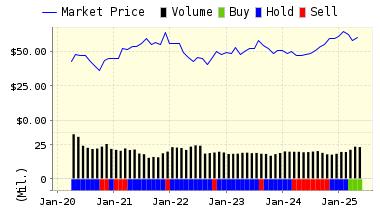

VALUENGINE RECOMMENDATION: ValuEngine continues its BUY recommendation on Cisco Systems for 2018-02-15. Based on the information we have gathered and our resulting research, we feel that Cisco Systems has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Momentum.

You can download a free copy of detailed report on Cisco Systems, Inc. (CSCO) from the link below.

Read our Complete Rating and Forecast Report HERE.

ValuEngine Forecast |

||

Target Price* |

Expected Return |

|

|---|---|---|

1-Month |

44.44 | 0.82% |

3-Month |

45.11 | 2.34% |

6-Month |

46.85 | 6.29% |

1-Year |

48.42 | 9.85% |

2-Year |

54.75 | 24.21% |

3-Year |

56.78 | 28.81% |

Valuation & Rankings |

|||

Valuation |

41.86% overvalued | Valuation Rank(?) | |

1-M Forecast Return |

0.82% | 1-M Forecast Return Rank | |

12-M Return |

34.31% | Momentum Rank(?) | |

Sharpe Ratio |

0.73 | Sharpe Ratio Rank(?) | |

5-Y Avg Annual Return |

14.06% | 5-Y Avg Annual Rtn Rank | |

Volatility |

19.34% | Volatility Rank(?) | |

Expected EPS Growth |

3.15% | EPS Growth Rank(?) | |

Market Cap (billions) |

225.41 | Size Rank | |

Trailing P/E Ratio |

19.86 | Trailing P/E Rank(?) | |

Forward P/E Ratio |

19.25 | Forward P/E Ratio Rank | |

PEG Ratio |

6.30 | PEG Ratio Rank | |

Price/Sales |

4.72 | Price/Sales Rank(?) | |

Market/Book |

6.91 | Market/Book Rank(?) | |

Beta |

1.24 | Beta Rank | |

Alpha |

0.04 | Alpha Rank | |

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

If you no longer wish to receive this free newsletter, CLICK HERE to unsubscribe