May 11, 2018

This week, we provide top-five ranked VE data for our Oil and Energy Sector stocks. We take a look at our latest data on AT&T $T and provide a free download link for our stock report on the company.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Index

|

Week Open

|

Friday PM

|

Change

|

% Change

|

YTD

|

DJIA |

24317.66 |

24772.84 |

455.18 |

1.87% |

0.22% |

NASDAQ |

7241.82 |

7386.18 |

144.3602 |

1.99% |

6.99% |

RUSSELL 2000 |

1565.72 |

1603.84 |

38.12003 |

2.43% |

4.45% |

S&P 500 |

2680.34 |

2722.69 |

42.35 |

1.58% |

1.84% |

ValuEngine Market Overview

Summary of VE Stock Universe |

|

Stocks Undervalued |

47.63% |

Stocks Overvalued |

52.37% |

Stocks Undervalued by 20% |

17.42% |

Stocks Overvalued by 20% |

19.77% |

ValuEngine Sector Overview

Sector

|

Change

|

MTD

|

YTD

|

Valuation

|

Last 12-MReturn

|

P/E Ratio

|

-0.03% |

0.06% |

4.69% |

17.25% overvalued |

19.43% |

24.57 |

|

0.86% |

4.12% |

4.46% |

16.39% overvalued |

23.56% |

31.85 |

|

0.03% |

2.61% |

6.87% |

8.54% overvalued |

36.64% |

28.37 |

|

0.09% |

2.26% |

4.44% |

6.79% overvalued |

15.80% |

24.91 |

|

0.54% |

1.42% |

-1.37% |

4.82% overvalued |

14.53% |

26.60 |

|

-0.12% |

0.19% |

-2.46% |

4.36% overvalued |

10.79% |

24.31 |

|

0.36% |

0.86% |

-3.23% |

3.55% overvalued |

10.12% |

23.59 |

|

0.41% |

1.34% |

0.56% |

2.77% overvalued |

9.51% |

18.03 |

|

0.45% |

0.44% |

-3.77% |

2.15% overvalued |

11.19% |

25.77 |

|

0.67% |

1.25% |

-4.36% |

2.12% overvalued |

2.52% |

22.43 |

|

0.29% |

1.25% |

-1.48% |

0.98% overvalued |

13.88% |

24.40 |

|

0.43% |

3.04% |

-0.81% |

1.02% undervalued |

20.01% |

20.24 |

|

0.86% |

2.31% |

3.30% |

1.71% undervalued |

7.81% |

23.55 |

|

0.13% |

0.87% |

1.03% |

2.27% undervalued |

17.69% |

22.98 |

|

0.42% |

3.48% |

6.55% |

6.90% undervalued |

10.30% |

26.46 |

|

1.60% |

3.29% |

-4.92% |

7.22% undervalued |

10.69% |

13.12 |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

Sector Talk--Oils and Energy

Below, we present the latest data on Oils and Energy

stocks from our Professional Stock Analysis Service. Top-

five lists are provided for each category. We applied some basic

liquidity criteria--share price greater than $3 and average daily

volume in excess of 100k shares.

Top-Five Oils and Energy Stocks--Short-Term Forecast Returns

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

RUN |

SUNRUN INC |

11.5 |

77.43% |

125.93% |

MDR |

MCDERMOTT INTL |

20.7 |

133.39% |

202.63% |

SEDG |

SOLAREDGE TECH |

64.85 |

47.87% |

268.47% |

CVRR |

CVR REFINING LP |

18.85 |

44.99% |

83.01% |

FSLR |

FIRST SOLAR INC |

73.01 |

56.05% |

99.64% |

Top-Five Oils and Energy Stocks--Momentum

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

IO |

ION GEOPHYSICAL |

27.35 |

-38.16% |

514.61% |

ENPH |

ENPHASE ENERGY |

5.21 |

-37.12% |

391.51% |

LGCY |

LEGACY RESERVES |

7.78 |

N/A |

279.51% |

SEDG |

SOLAREDGE TECH |

64.85 |

47.87% |

268.47% |

WTI |

W&T OFFSHORE |

7.46 |

-28.04% |

253.55% |

Top-Five Oils and Energy Stocks--Composite Score

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

HCC |

WARRIOR MET COA |

26.45 |

-18.17% |

53.42% |

WTI |

W&T OFFSHORE |

7.46 |

-28.04% |

253.55% |

CNQ |

CDN NTRL RSRCS |

36.23 |

-45.46% |

15.20% |

BTU |

PEABODY ENERGY |

38.06 |

-75.00% |

50.67% |

SRCI |

SRC ENERGY INC |

12.17 |

-2.74% |

61.62% |

Top-Five Oils and Energy Stocks--Most Overvalued

Ticker |

Name |

Mkt Price |

Valuation (%) |

Last 12-M Return (%) |

AMRS |

AMYRIS INC |

5.83 |

300.00% |

14.94% |

RIG |

TRANSOCEAN LTD |

13.42 |

220.75% |

20.14% |

DO |

DIAMOND OFFSHOR |

20.08 |

183.23% |

33.33% |

RDC |

ROWAN COS PLC |

16.21 |

138.75% |

16.45% |

MDR |

MCDERMOTT INTL |

20.7 |

133.39% |

202.63% |

Free Download for Readers

As a bonus to our Free Weekly Newsletter subscribers,

we are offering a FREE DOWNLOAD of one of our Stock Reports

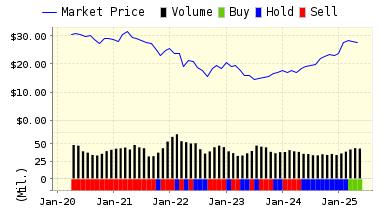

AT&T (T) provides communication, entertainment and internet services to consumers and businesses around the world. In the U.S., the company is the largest pay-TV provider and owns the second largest wireless network. AT&T provides connectivity, security, broadband, video and voice services under the AT&T, U-verse and DIRECTV brands.

VALUENGINE RECOMMENDATION: ValuEngine continues its SELL recommendation on AT&T INC for 2018-05-10. Based on the information we have gathered and our resulting research, we feel that AT&T INC has the probability to UNDERPERFORM average market performance for the next year. The company exhibits UNATTRACTIVE Momentum and Earnings Growth Rate.

You can download a free copy of detailed report on AT&T (T) from the link below.

Read our Complete Rating and Forecast Report HERE.

ValuEngine Forecast |

||

Target Price* |

Expected Return |

|

|---|---|---|

1-Month |

31.60 | -0.89% |

3-Month |

31.44 | -1.39% |

6-Month |

30.09 | -5.60% |

1-Year |

28.46 | -10.73% |

2-Year |

30.97 | -2.85% |

3-Year |

32.96 | 3.40% |

Valuation & Rankings |

|||

Valuation |

19.01% undervalued | Valuation Rank(?) | |

1-M Forecast Return |

-0.89% | 1-M Forecast Return Rank | |

12-M Return |

-17.09% | Momentum Rank(?) | |

Sharpe Ratio |

-0.16 | Sharpe Ratio Rank(?) | |

5-Y Avg Annual Return |

-2.72% | 5-Y Avg Annual Rtn Rank | |

Volatility |

16.65% | Volatility Rank(?) | |

Expected EPS Growth |

7.62% | EPS Growth Rank(?) | |

Market Cap (billions) |

165.36 | Size Rank | |

Trailing P/E Ratio |

9.98 | Trailing P/E Rank(?) | |

Forward P/E Ratio |

9.28 | Forward P/E Ratio Rank | |

PEG Ratio |

1.31 | PEG Ratio Rank | |

Price/Sales |

1.04 | Price/Sales Rank(?) | |

Market/Book |

1.12 | Market/Book Rank(?) | |

Beta |

0.38 | Beta Rank | |

Alpha |

-0.23 | Alpha Rank | |

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.com