August 22, 2018

EDITOR'S NOTE: We will be on a limited publication schedule later this month. Bulletins will be reduced the weeks of August 20-24 (we will publish M-W) and September 3-7 (we will publish W-F). There will be no bulletins the week of August 27-31. We will return to our normal publication schedule the week of September 10th.

For today's bulletin, we take a look at our latest STRONG BUY and BUY upgrades. We also provide a link to download a FREE STOCK REPORT on AVNET Inc $AVT, one of our top upgrades for the day.

VALUATION WATCH: Overvalued

stocks now make up 51.82% of our stocks assigned a valuation and 21.98% of

those equities are calculated to be overvalued by 20% or more.

Thirteen sectors are calculated to be overvalued.

If you cannot display this bulletin properly, GO HERE

To subscribe to our bulletins and receive content whenever it is published, subscribe at our blog HERE

--UPGRADES

AVNET Upgraded to BUY by ValuEngine

For today's edition of our upgrade list, we used our website's advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. ALL of our top upgrades are rated BUY, we had no upgrades to STRONG BUY for today..

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Return |

1-M Forecast Return |

1-Yr Forecast Return |

P/E Ratio |

Sector Name |

PINC |

PREMIER INC-A |

43.95 |

25.88% |

34.08% |

0.71% |

8.52% |

20.83 |

Medical |

ZOES |

ZOES KITCHEN |

13.35 |

22.53% |

4.54% |

0.54% |

6.53% |

N/A |

Retail-Wholesale |

NXST |

NEXSTAR BRDCSTG |

81.4 |

19.24% |

34.99% |

0.54% |

6.50% |

14.00 |

Consumer Discretionary |

AVT |

AVNET |

49.14 |

18.56% |

36.77% |

0.53% |

6.34% |

13.54 |

Computer and Technology |

CASY |

CASEYS GEN STRS |

116.92 |

20.45% |

13.21% |

0.52% |

6.28% |

29.60 |

Retail-Wholesale |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

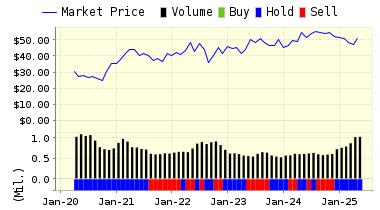

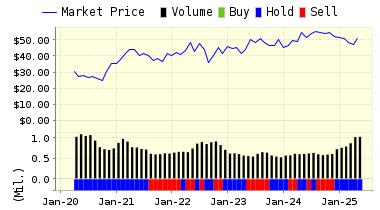

For today's bulletin, we look at Avnet Inc. (AVT). Avnet Inc. is one of the world's largest industrial distributors of electronic components and computer products. The company is a vital link in the chain that connects suppliers of semiconductors, interconnect products, passive and electromechanical devices to original equipment manufacturers and contract manufacturers that design and build the electronic equipment for end-market use, and to other industrial customers. The company markets, distributes and optimizes the supply-chain and provides design-chain services for the products of the world's leading electronic component suppliers, enterprise computer manufacturers and embedded subsystem providers. Avnet brings a breadth and depth of capabilities, such as maximizing inventory efficiency, managing logistics, assembling products and providing engineering design assistance for its customers, accelerating their growth through cost-effective, value-added services and solutions.

This stock has been on a tear of late, hitting a 52-week high recently thanks to very strong Q4 earnings and a strong guidance statment from management. AVNET has posted impressive gains all year, and has appreciated @20% vs a growth rate of only @1.5% for its industry.

ValuEngine updated its recommendation from HOLD to BUY for AVNET on 2018-08-21. Based on the information we have gathered and our resulting research, we feel that AVNET has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Price Sales Ratio and Company Size.

You can download a free copy of detailed report on Avnet Inc. (AVT) from the link below.

ValuEngine Forecast |

| |

Target

Price* |

Expected

Return |

1-Month |

49.40 |

0.53% |

3-Month |

49.72 |

1.18% |

6-Month |

51.00 |

3.79% |

1-Year |

52.25 |

6.34% |

2-Year |

60.78 |

23.68% |

3-Year |

66.35 |

35.02% |

Valuation & Rankings |

Valuation |

18.56% overvalued |

|

24 24 |

1-M Forecast Return |

0.53% |

1-M Forecast Return Rank |

86 86 |

12-M Return |

36.77% |

|

82 82 |

Sharpe Ratio |

0.16 |

|

60 60 |

5-Y Avg Annual Return |

3.04% |

5-Y Avg Annual Rtn Rank |

57 57 |

Volatility |

18.45% |

|

71 71 |

Expected EPS Growth |

16.71% |

|

50 50 |

Market Cap (billions) |

6.70 |

Size Rank |

84 84 |

Trailing P/E Ratio |

13.54 |

|

81 81 |

Forward P/E Ratio |

11.60 |

Forward P/E Ratio Rank |

72 72 |

PEG Ratio |

0.81 |

PEG Ratio Rank |

46 46 |

Price/Sales |

0.35 |

|

89 89 |

Market/Book |

1.92 |

|

57 57 |

Beta |

0.86 |

Beta Rank |

44 44 |

Alpha |

0.02 |

Alpha Rank |

67 67 |

DOWNLOAD A FREE SAMPLE OF OUR AVNET (AVT) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine's award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.Com |