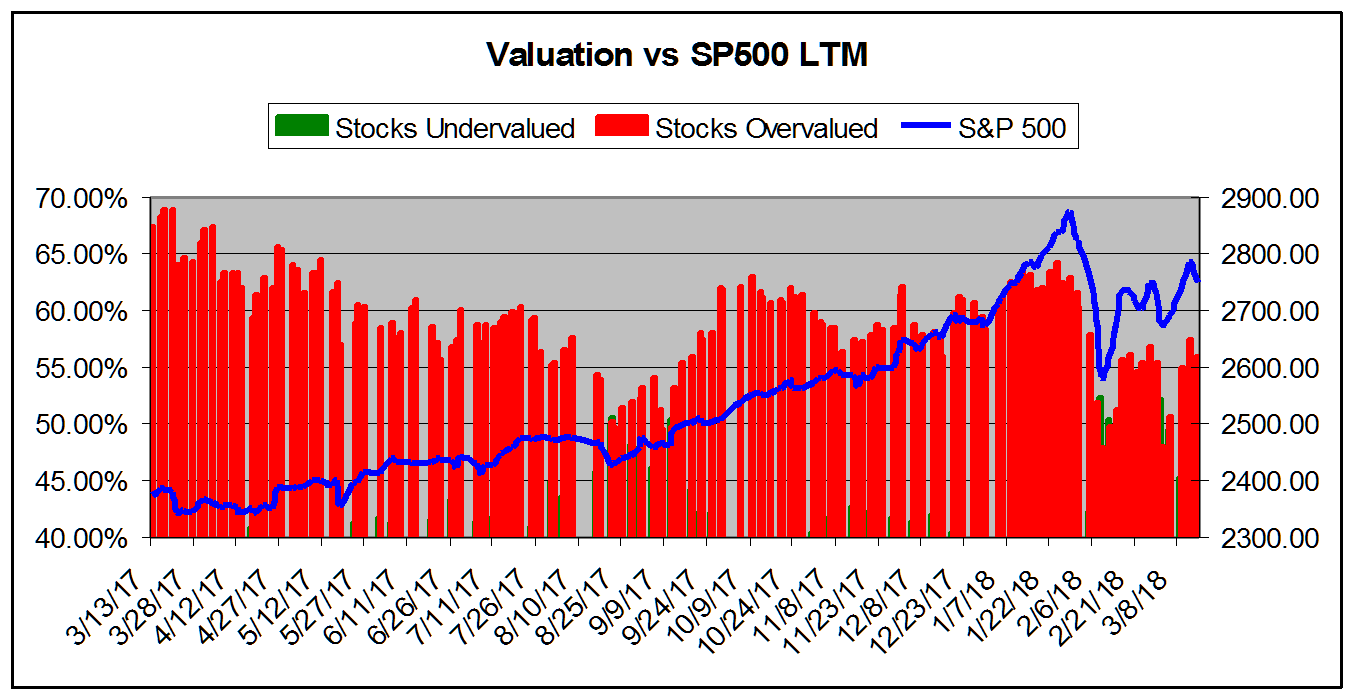

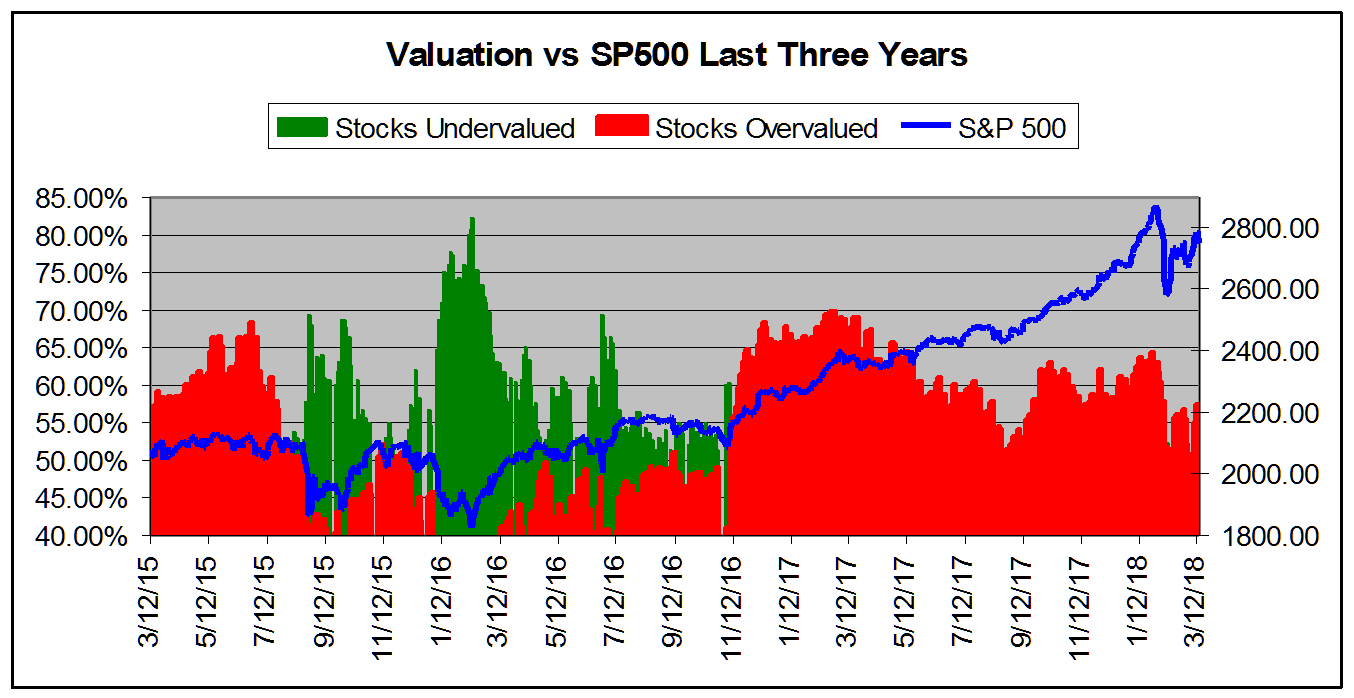

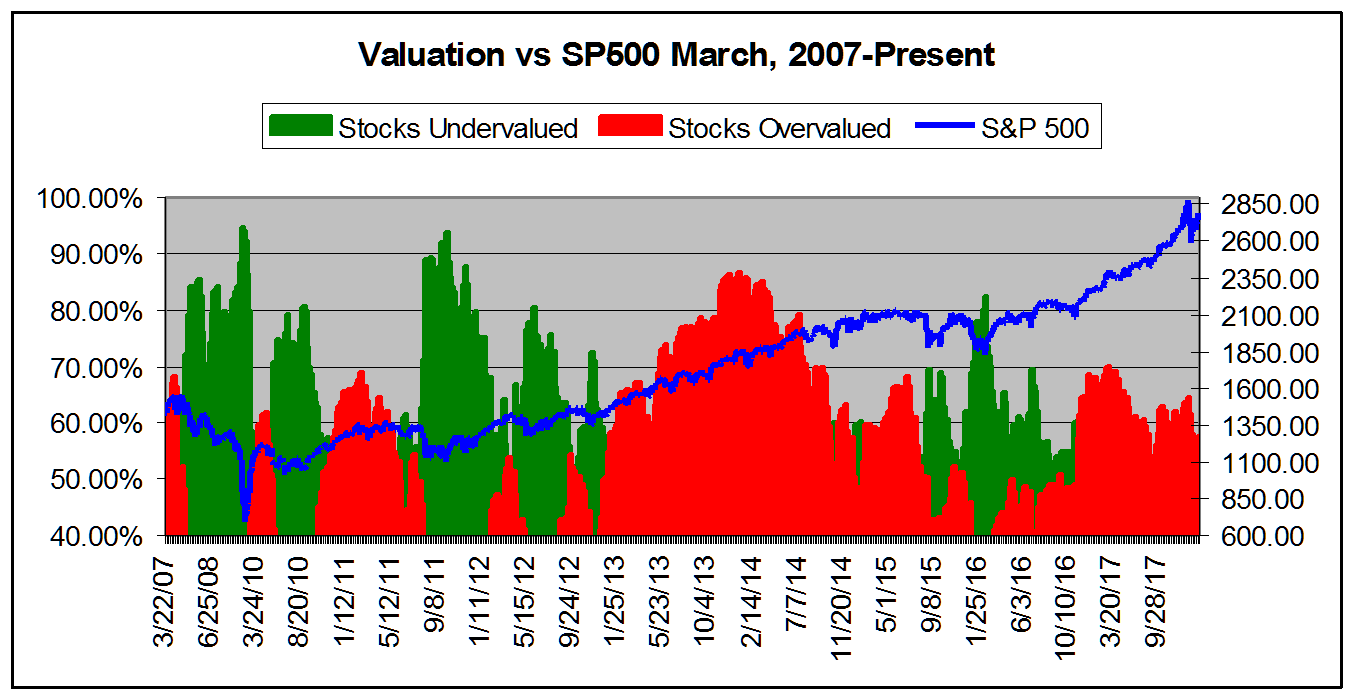

March 19, 2018For today's bulletin, we take a look at our latest historical market valuation calculations. If you cannot display this bulletin properly, GO HERE ValuEngine: Market Valuation Remains Within Normal RangeValuEngine tracks more than 5000 US equities, ADRs, and foreign stock which trade on US exchanges as well as @1000 Canadian equities. When EPS estimates are available for a given equity, our model calculates a level of mispricing or valuation percentage for that equity based on earnings estimates and what the stock should be worth if the market were totally rational and efficient--an academic exercise to be sure, but one which allows for useful comparisons between equities, sectors, and industries. Using our Valuation Model, we can currently assign a VE valuation calculation to more than 2800 stocks in our US Universe. We combine all of the equities with a valuation calculation to track market valuation figures and use them as a metric for making calls about the overall state of the market. Two factors can lower these figures-- a market pullback, or a significant rise in EPS estimates. Vice-versa, a significant rally or reduction in EPS can raise the figure. Whenever we see overvaluation levels in excess of @ 65% for the overall universe and/or 27% for the overvalued by 20% or more categories, we issue a valuation warning. We now calculate that 56.07% of the stocks to which we can assign a valuation are overvalued and 21.35% of those stocks are overvalued by 20% or more. These numbers have increased slightly compared to what we saw when we published our last valuation study in August, 2017. At that time, we saw an overvaluation figure of 52.16%. Currently, the numbers do not indicate that the market is overheated and things have stabilized as the the earnings picture has improved and share prices appear more reasonable to our models. Of course, when it comes to US foreign policy, peace and negotiations are better for stocks than bluster and war. Domestically, one cannot help but think that Trump occupies an ever-shrinking patch of ground, with Mueller appearing to be closing in on the "big fish" with every new subpoena and indictment. Would impeachment be plus or a minus for stocks? One can imagine the shock would cause damage, but perhaps we could see a "relief rally" as well as investors might value a return to steady direction and "normalcy" in DC. We do however, find that replacing a Gary Cohn with a Larry Kudlow as Trump's primary economic advisor will be a negative given Kudlow's long and well-documented record of being wrong about almost everything when it comes to the markets and policy--seriously, google it, the internet has already provided numerous accounts of some of Kudlow's more ridiculous calls and predictions. Indeed, much of the post-war world order was created by the US precisely to bind nations together through open trade so that all could compete. This was also of great benefit to the US and its own economy. The Bannon wing of the GOP-- and Trump himself --seem to forget this history as they tear up international trade agreements and proclaim trade wars "easy." They also damage US credibility when they make blatantly untrue statements about various trade balances and then try to lie about their factual inaccuracies in order to make them appear correct after the fact. Numbers don't lie! The chart below tracks the valuation metrics from March 2017. It shows levels in excess of 40%. Here you can see our recent-past Valuation Watches--when the red bars exceeded 60%. This chart shows overall universe over valuation in excess of 40% vs the S&P 500 from March 2015. Here we see that the last really long-term buying opportunity occurred back in early 2016. The undervalued condition has not really held sway since then. This chart shows overall universe under and over valuation in excess of 40% vs the S&P 500 from March 2007.* Look at that growth since the markets bottomed out after Bush the Younger's financial collapse and Great Recession. We've come so far since that "devilish" 666 inter day SP500 low of March 9, 2008! Notice too that the long-term chart put the so-called "Trump rally" in its proper context. We've been on a bull run most of the time since that low. You'd be hard pressed to figure out when the Obama administration gave way to Trump without the date labels on the X-axis.

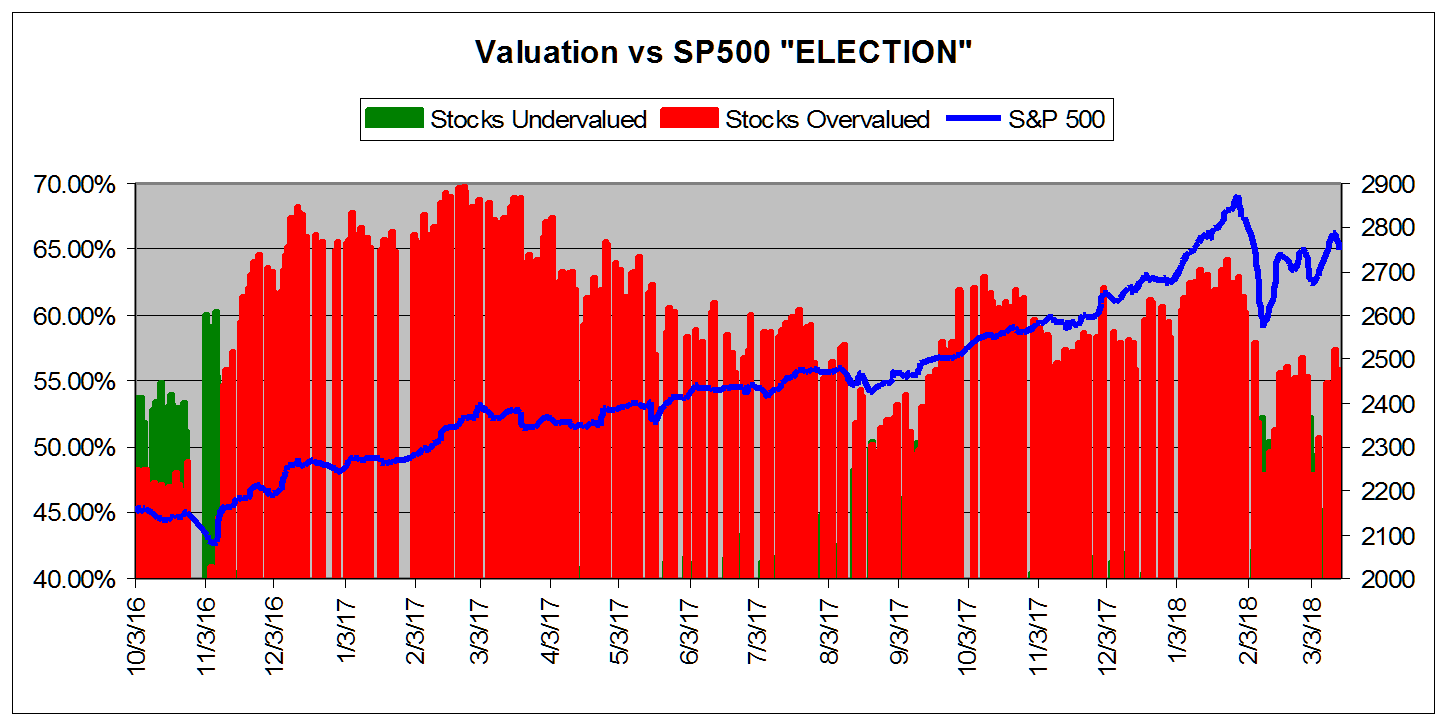

Finally, this chart shows the market from October 2016-present. We use this one to evaluate the so-called "Trump rally" for the markets. Again, a nice leg up, but that dip at the beginning of February sure raised some doubts for this particular vein of Trump triumphalism. ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com Visit www.ValuEngine.com for more information ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine's award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com Visit www.ValuEngineCapital.com for more information

|

||