December 7, 2016

VALUATION WATCH: Overvalued stocks now make up 64.59% of our stocks assigned a valuation and 32.16% of those equities are calculated to be overvalued by 20% or more. Fifteen sectors are calculated to be overvalued.

If you cannot display this bulletin properly, GO HERE

Healthy Choice

Health Insurance Innovations Is Leading STRONG BUY For ValuEngine

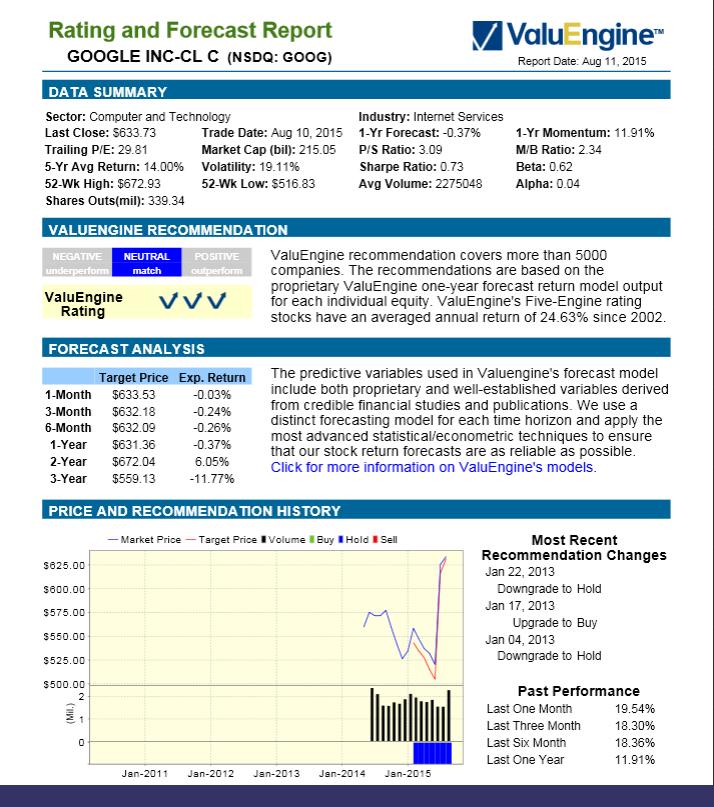

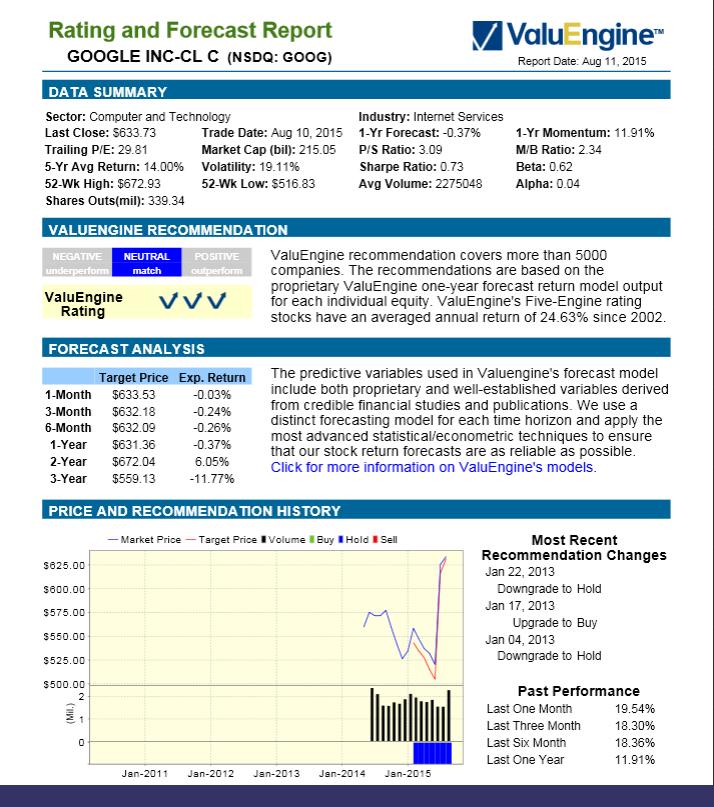

We use trading data to provide forecast estimates for a variety of time horizons for almost ever equity in our database. Our Buy/Sell/Hold recommendations are based upon the 1-year forecast return figure. Using valuation and forecast figures, you can rank and rate our covered stocks against each other, to find out, in an objective and systematic way, the most attractive investment targets based on your own risk/reward parameters. We re-calculate the entire database every trading day, so you are assured that every proprietary valuation and forecast datapoint is as up-to-date as possible.

For today's bulletin we used our website's advanced-screening functions to search for the top-rated STRONG BUY US stock with valuation data that meets minimum liquidity requirements. Our leader is Health Insurance Innovations, Inc. (HIIQ).

Health Insurance Innovations, Inc. operates as a developer and administrator of web-based individual health insurance plans and ancillary products. Its product portfolio consists of short-term medical plans, accident, sickness & hospital medical plans, ancillary insurance, life insurance, lifestyle and discount services. Health Insurance Innovations, Inc. is based in Tampa, Florida.

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on Health Insurance Innovations, Inc. for 2016-12-06. Based on the information we have gathered and our resulting research, we feel that Health Insurance Innovations, Inc. has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and P/E Ratio.

You can download a free copy of detailed report on Health Insurance Innovations, Inc. (HIIQ) from the link below.

ValuEngine Forecast |

| |

Target

Price* |

Expected

Return |

1-Month |

13.63 |

1.37% |

3-Month |

13.59 |

1.07% |

6-Month |

13.70 |

1.85% |

1-Year |

15.67 |

16.48% |

2-Year |

11.40 |

-15.26% |

3-Year |

9.51 |

-29.31% |

Valuation & Rankings |

Valuation |

13.74% undervalued |

|

80 80 |

1-M Forecast Return |

1.37% |

1-M Forecast Return Rank |

100 100 |

12-M Return |

133.91% |

|

96 96 |

Sharpe Ratio |

0.03 |

|

55 55 |

5-Y Avg Annual Return |

2.07% |

5-Y Avg Annual Rtn Rank |

58 58 |

Volatility |

77.03% |

|

20 20 |

Expected EPS Growth |

19.64% |

|

56 56 |

Market Cap (billions) |

0.20 |

Size Rank |

43 43 |

Trailing P/E Ratio |

14.67 |

|

79 79 |

Forward P/E Ratio |

12.26 |

Forward P/E Ratio Rank |

74 74 |

PEG Ratio |

0.75 |

PEG Ratio Rank |

51 51 |

Price/Sales |

1.19 |

|

63 63 |

Market/Book |

7.05 |

|

18 18 |

Beta |

0.25 |

Beta Rank |

73 73 |

Alpha |

0.90 |

Alpha Rank |

97 97 |

DOWNLOAD A FREE SAMPLE OF OUR HEALTH INSURANCE INNOVATIONS (HIIQ) REPORT BY CLICKING HERE

ValuEngine Market Overview

Summary of VE Stock Universe |

Stocks Undervalued |

35.41% |

Stocks Overvalued |

64.59% |

Stocks Undervalued by 20% |

15.93% |

Stocks Overvalued by 20% |

32.16% |

ValuEngine Sector Overview

|

|

|

|

|

|

|

|

0.63% |

1.93% |

27.16% |

23.36% overvalued |

21.06% |

23.91 |

|

0.65% |

2.07% |

12.73% |

20.09% overvalued |

8.96% |

19.30 |

|

0.35% |

0.83% |

14.27% |

19.05% overvalued |

11.08% |

20.25 |

|

0.42% |

2.52% |

31.06% |

17.70% overvalued |

22.62% |

25.83 |

|

0.54% |

2.46% |

58.47% |

16.66% overvalued |

64.21% |

27.50 |

|

0.80% |

1.62% |

15.34% |

14.16% overvalued |

9.74% |

17.90 |

|

0.80% |

1.68% |

36.35% |

13.91% overvalued |

18.71% |

20.52 |

|

0.99% |

1.85% |

20.21% |

12.95% overvalued |

7.42% |

18.45 |

|

0.61% |

0.89% |

23.48% |

10.36% overvalued |

4.59% |

23.66 |

|

0.61% |

0.40% |

20.55% |

10.20% overvalued |

8.47% |

29.85 |

|

0.52% |

1.17% |

3.72% |

8.96% overvalued |

4.60% |

23.62 |

|

0.43% |

0.72% |

10.76% |

7.70% overvalued |

9.58% |

23.37 |

|

0.44% |

1.68% |

12.53% |

7.28% overvalued |

18.04% |

14.72 |

|

0.45% |

0.54% |

13.63% |

6.12% overvalued |

16.13% |

21.90 |

|

0.38% |

0.42% |

7.86% |

2.77% overvalued |

3.62% |

23.94 |

|

0.23% |

0.31% |

-0.88% |

3.76% undervalued |

-7.61% |

27.61 |

ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and valuations on over 7,000 US and Canadian equities every trading day.

Visit www.ValuEngine.com for more information

|