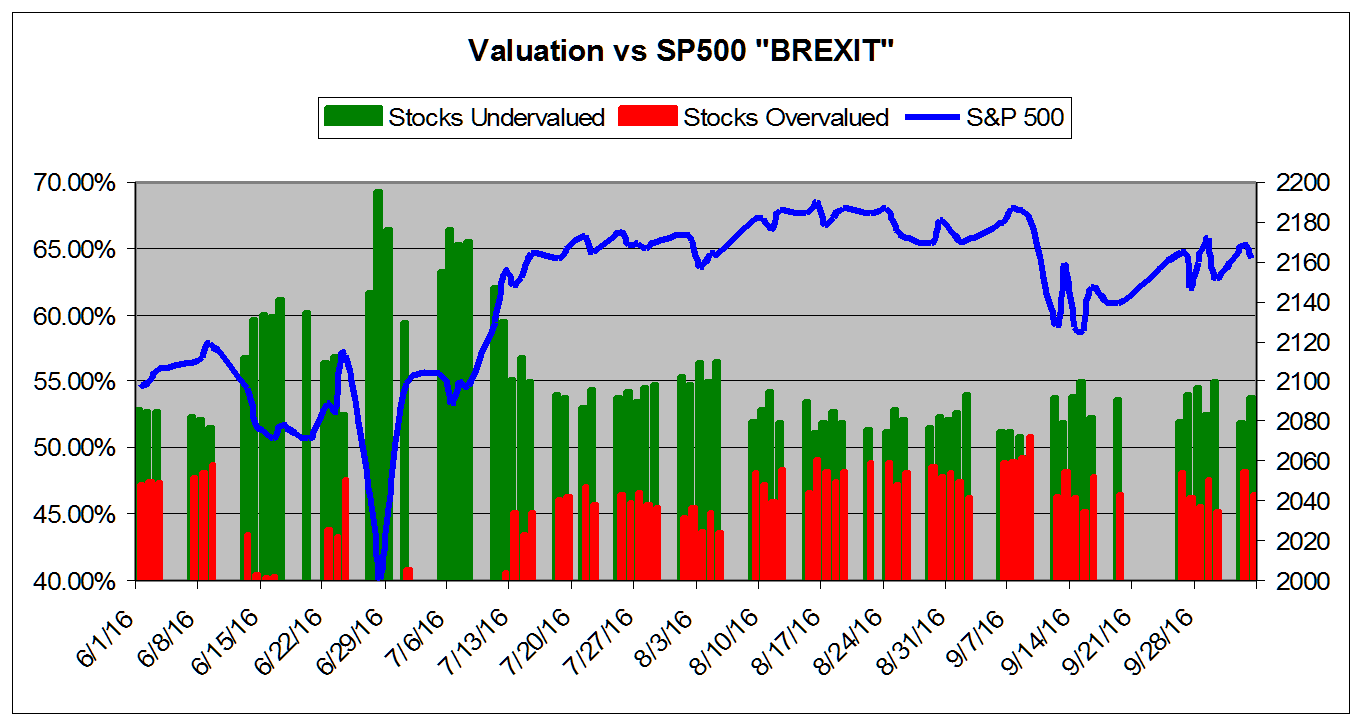

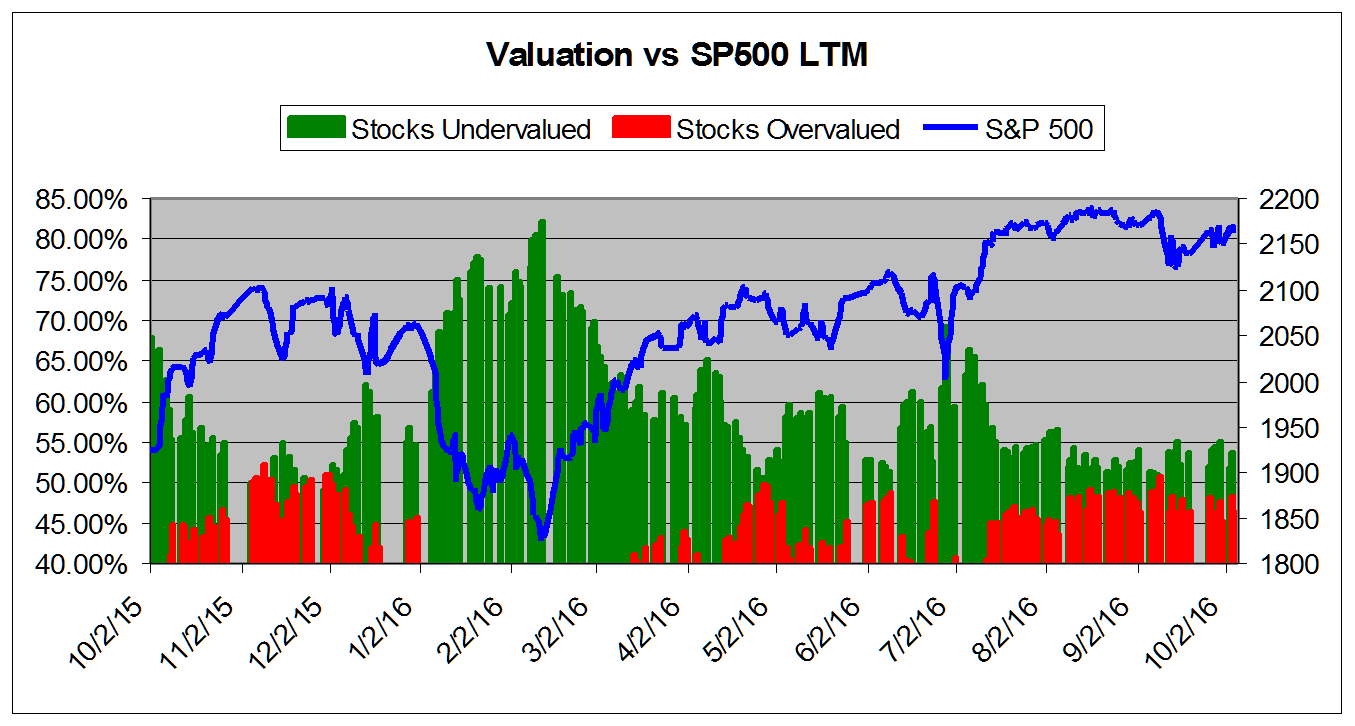

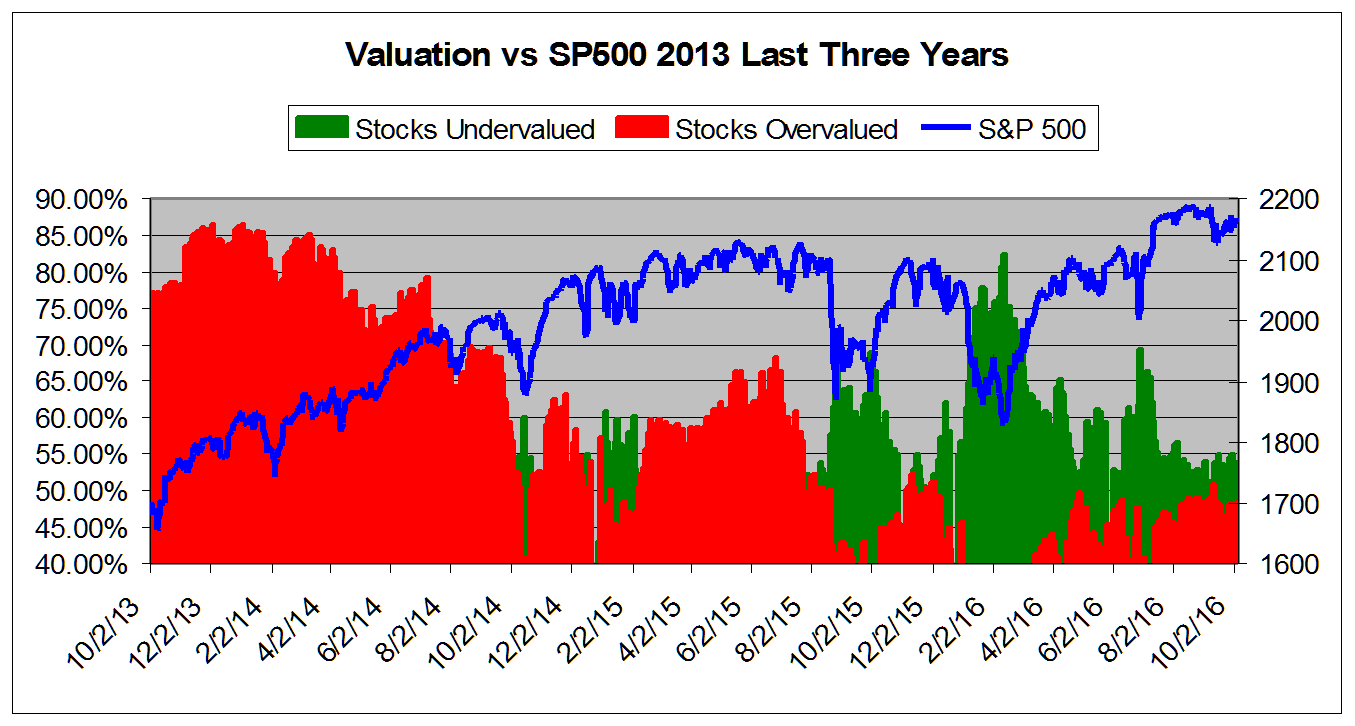

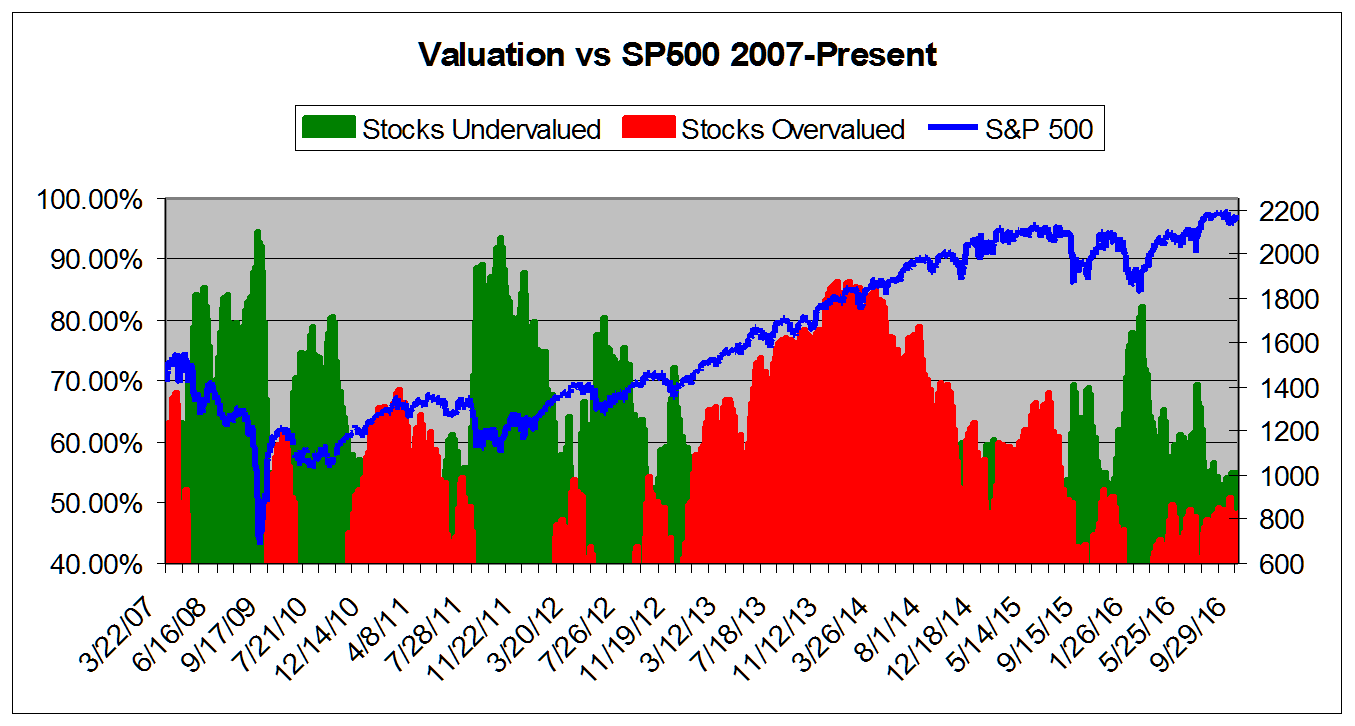

October 5, 2016VALUATION WATCH: Overvalued stocks now make up 46.33% of our stocks assigned a valuation and 14.43% of those equities are calculated to be overvalued by 20% or more. Six sectors are calculated to be overvalued. If you cannot display this bulletin properly, GO HERE FlatliningValuEngine Finds "Normal" Valuations As US Election ApproachesValuEngine tracks more than 7000 US equities, ADRs, and foreign stock which trade on US exchanges as well as @1000 Canadian equities. When EPS estimates are available for a given equity, our model calculates a level of mispricing or valuation percentage for that equity based on earnings estimates and what the stock should be worth if the market were totally rational and efficient--an academic exercise to be sure, but one which allows for useful comparisons between equities, sectors, and industries. Using our Valuation Model, we can currently assign a VE valuation calculation to more than 2800 stocks in our US Universe. We combine all of the equities with a valuation calculation to track market valuation figures and use them as a metric for making calls about the overall state of the market. Two factors can lower these figures-- a market pullback, or a significant rise in EPS estimates. Vice-versa, a significant rally or reduction in EPS can raise the figure. Whenever we see overvaluation levels in excess of @ 65% for the overall universe and/or 27% for the overvalued by 20% or more categories, we issue a valuation warning. We now calculate that 46.33% of the stocks to which we can assign a valuation are overvalued and 14.43% of those stocks are overvalued by 20% or more. These numbers have decreased-- slightly-- since we published our valuation study in August-- when the overvaluation was at 48.83%. Since August, we have seen some fluctuations--and even a day where we were up above 50% overvaluation--but not much change. The markets called the recent (non) Fed move perfectly. No rate increase for now, but “signals” indicating that the central bank would like to raise rates at least once more in the waning days of 2016. We still think that is a bad idea and that until we have strong signs that the labor market has recovered from the Bush recession and wages are well on the way to recovery it makes no sense to raise rates. The Fed noted that “the Committee judges that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of continued progress toward its objectives." Of course, those objectives are to maintain a sensible level of inflation (2% currently) and support “full employment” (which was historically set at @5%.) Regardless, 2016 looks highly unlikely to see rates in excess of 0.5 and 0.75%. Keep in mind though that a Trump victory in November has the potential to wreak havoc on the markets due to the shock and uncertainty. That is the next moment of unknown outcomes that could unsettle investors and shake up global asset flows. A candidate who has stated that "debt was sort of always interesting to me. Now we're in a different situation with the country. But I would borrow, knowing that if the economy crashed, you could make a deal. And if the economy was good, it was good. So, therefore, you can't lose. It's like, you know, you make a deal before you go into a poker game, and your odds are so much better" does not soudn like a candidate totally devoted to the "full faith and credit" of the United States. In the event of an unlikely--as of this writing--Trump victory in November, those sorts of sentiments and public statements are sure to give investors pause and may challenge the US status as the preferred currency across the globe. Currently, polling and political futures markets indicate that this is an unlikely November "surprise," but we should be wary of the potential fallout.. The chart below tracks the valuation metrics so far this Summer. It encompasses the Brexit sell off. It shows levels in excess of 40%. The chart below tracks the valuation metrics from August 2015. It shows levels in excess of 40%. This chart shows overall universe over valuation in excess of 40% vs the S&P 500 from August 2013 This chart shows overall universe under and over valuation in excess of 40% vs the S&P 500 from March 2007*

ValuEngine Market Overview

ValuEngine Sector Overview

ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and valuations on over 7,000 US and Canadian equities every trading day.

Visit www.ValuEngine.com for more information |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||