October 5, 2016VALUATION WATCH: Overvalued stocks now make up 46.36% of our stocks assigned a valuation and 14.59% of those equities are calculated to be overvalued by 20% or more. Eight sectors are calculated to be overvalued. If you cannot display this bulletin properly, GO HERE Stock of SteelAK Steel Holdings Is Leading ValuEngine STRONG BUY

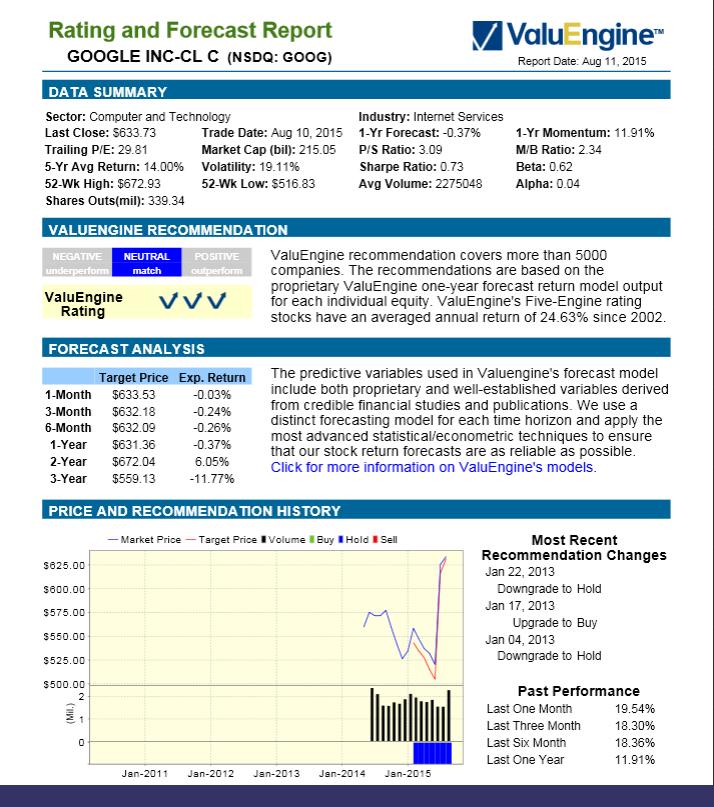

For today's bulletin we used our website's advanced-screening functions to search for the top-rated STRONG BUY US stock with valuation data that meets minimum liquidity requirements. Our leader is AK Steel Holding Corporation (AKS). AK Steel Holding Corporation (AKS) is an integrated producer of flat-rolled carbon, stainless and electrical steels and tubular products through its subsidiary, AK Steel Corporation (AK Steel). The Company operates approximately eight steelmaking and finishing plants, over two coke plants and approximately two tube manufacturing plants across states, which include Indiana, Kentucky, Michigan, Ohio, Pennsylvania and West Virginia. These operations produce flat-rolled carbon, specialty stainless and electrical steels that it sells in sheet and strip form, and carbon and stainless steel that it finishes into welded steel tubing. The Company also produces metallurgical coal through its subsidiary, AK Coal Resources, Inc. (AK Coal). In addition, the Company operates trading companies in Mexico and Europe that buy and sell steel and steel products and other materials. It sells flat-rolled carbon steel products, consisting of coated, cold-rolled, and hot-rolled carbon steel products. ValuEngine continues its STRONG BUY recommendation on AK Steel Holding Corporation for 2016-10-03. Based on the information we have gathered and our resulting research, we feel that AK Steel Holding Corporation has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Price Sales Ratio and Momentum.

DOWNLOAD A FREE SAMPLE OF OUR AK STEEL HOLDINGS (AKS) REPORT BY CLICKING HERE

ValuEngine Market Overview

ValuEngine Sector Overview

ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and valuations on over 7,000 US and Canadian equities every trading day.

Visit www.ValuEngine.com for more information |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||