June 14, 2016

VALUATION WATCH: Overvalued stocks now make up 40.41% of our stocks assigned a valuation and 13.54% of those equities are calculated to be overvalued by 20% or more. Six sectors are calculated to be overvalued.

If you cannot display this bulletin properly, GO HERE

New Developments

Apple Announces Latest Upgrades at WWDC 2016

Apple Inc. (AAPL) is engaged in designing, manufacturing and marketing mobile communication and media devices, personal computers, and portable digital music players. The Company's products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and Mac OS X operating systems, iCloud, and a range of accessory, service and support offerings. It sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers. Apple Inc. is headquartered in Cupertino, California.

Yesterday was the big Apple event, WWDC 2016. As has been the case lately, the company announced a variety of incremental updates to existing products rather than stunning their user base with some category-shattering device.

The latest iteration of the OS will be known as "Sierra" and will be released in beta form in July. The big news here is a new capability to more fully integrate with the cloud and across all Apple devices. Other developments include the porting of the popular iPhone AI assistant/"concierge" function--Siri--to the company's desktop computers, an expansion of the company's Apple Pay service to the web via the Apple Safari browser, and a new OS for the Apple watch. In addition, the company has updated its maps, news, and music services.

We often focus on Apple news because the company inspires such fanatical loyalty amongst its user base, but once again what we see here is a rather lackluster group of updates and changes that may not be enough to boost sales or attract new users to the world of Apple.

As analysts have noted for along time now, the company was so successful for so long that the big growth needed to support an ever-increasing share price was simply unsustainable. This is not to say it is a bad stock, a bad company, or that their products are not wonderful. But, the amount of explosive growth found when the company developed the iPod, the iPhone, and the iPad, was simply unsustainable because the company is just too large.

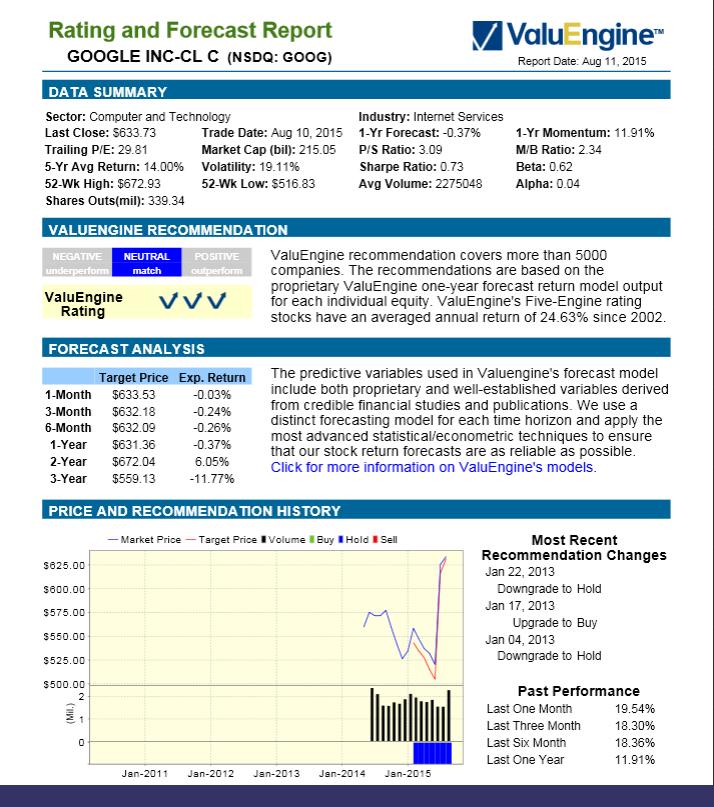

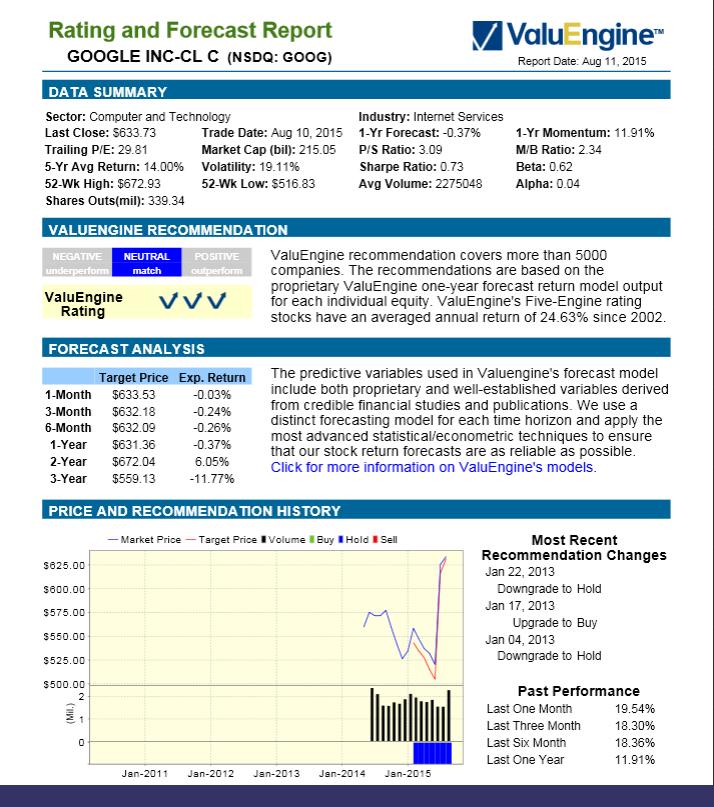

ValuEngine continues its HOLD recommendation on APPLE INC for 2016-06-13. Based on the information we have gathered and our resulting research, we feel that APPLE INC has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Earnings Growth Rate.

You can download a free copy of detailed report on Apple from the link below.

ValuEngine Forecast |

| |

Target

Price* |

Expected

Return |

1-Month |

97.38 |

0.05% |

3-Month |

98.14 |

0.82% |

6-Month |

99.44 |

2.16% |

1-Year |

97.87 |

0.54% |

2-Year |

105.15 |

8.02% |

3-Year |

102.18 |

4.97% |

Valuation & Rankings |

Valuation |

8.17% undervalued |

|

58 58 |

1-M Forecast Return |

0.05% |

1-M Forecast Return Rank |

55 55 |

12-M Return |

-23.46% |

|

34 34 |

Sharpe Ratio |

0.53 |

|

86 86 |

5-Y Avg Annual Return |

13.96% |

5-Y Avg Annual Rtn Rank |

88 88 |

Volatility |

26.18% |

|

64 64 |

Expected EPS Growth |

-1.73% |

|

22 22 |

Market Cap (billions) |

566.98 |

Size Rank |

100 100 |

Trailing P/E Ratio |

11.20 |

|

87 87 |

Forward P/E Ratio |

11.40 |

Forward P/E Ratio Rank |

73 73 |

PEG Ratio |

n/a |

PEG Ratio Rank |

n/a n/a |

Price/Sales |

2.49 |

|

37 37 |

Market/Book |

4.67 |

|

25 25 |

Beta |

0.98 |

Beta Rank |

46 46 |

Alpha |

-0.26 |

Alpha Rank |

26 26 |

DOWNLOAD A FREE SAMPLE OF OUR APPLE (AAPL) REPORT BY CLICKING HERE

ValuEngine Market Overview

Summary of VE Stock Universe |

Stocks Undervalued |

59.59% |

Stocks Overvalued |

40.41% |

Stocks Undervalued by 20% |

26.1% |

Stocks Overvalued by 20% |

13.54% |

ValuEngine Sector Overview

|

|

|

|

|

|

|

|

-0.81% |

3.91% |

33.74% |

8.73% overvalued |

18.48% |

28.84 |

|

-1.18% |

-0.41% |

4.32% |

6.80% overvalued |

1.71% |

23.31 |

|

-0.73% |

0.04% |

6.31% |

5.01% overvalued |

3.04% |

23.26 |

|

-1.16% |

-0.74% |

3.82% |

2.16% overvalued |

-9.73% |

17.90 |

|

-1.10% |

1.31% |

11.59% |

2.06% overvalued |

-31.18% |

22.81 |

|

-1.31% |

-0.18% |

5.33% |

0.52% overvalued |

-10.91% |

21.48 |

|

-1.73% |

-2.13% |

-3.96% |

1.34% undervalued |

-6.84% |

18.58 |

|

-1.33% |

-0.43% |

10.60% |

3.11% undervalued |

-11.32% |

22.65 |

|

-1.12% |

-0.82% |

5.96% |

3.30% undervalued |

-11.30% |

27.53 |

|

-0.96% |

-1.43% |

0.99% |

4.34% undervalued |

-5.70% |

15.77 |

|

-0.85% |

-0.95% |

1.61% |

4.75% undervalued |

-12.46% |

22.70 |

|

-1.48% |

-1.99% |

17.78% |

6.50% undervalued |

-6.32% |

20.44 |

|

-1.02% |

-0.65% |

-6.08% |

8.52% undervalued |

-22.08% |

26.73 |

|

-1.16% |

-0.66% |

1.57% |

9.44% undervalued |

-27.15% |

13.38 |

|

-1.41% |

-3.43% |

-3.73% |

11.31% undervalued |

-18.93% |

11.70 |

|

-1.29% |

-1.49% |

-5.00% |

12.76% undervalued |

-14.30% |

21.75 |

ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and valuations on over 7,000 US and Canadian equities every trading day.

Visit www.ValuEngine.com for more information

|